Article originally published in HiMSS Business Edge.

With the ACA repeal not clearing its first legislative hurdle, it appears that Obamacare will remain in effect for the foreseeable future. Payers and providers will need to continue to work together to implement new payment models that maximize performance for both parties under the ACA and MACRA frameworks.

Currently, ACO models promise to align payers and providers around the shared goals of keeping patients healthier and thus reducing the cost of care. In practice, however, creating the actual contracts that transform that theoretical alignment into mutually acceptable business commitments has been elusive. Two of the primary reasons for this have been organizations not understanding which types of alternative payment models will be the best fit for their organization, and not knowing how to structure payment contracts to maximize their immediate and strategic value to the organization.

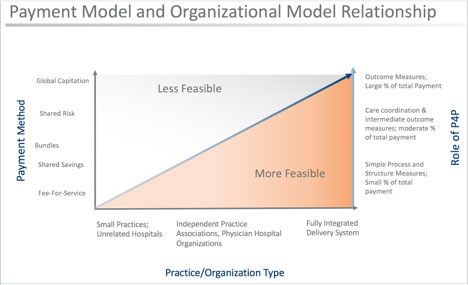

Figure 1: Payment Model and Organizational Model Relationship

Understanding where the care organization is along the value-based spectrum is necessary to determine which type of payment and risk sharing models are most appropriate – see Figure 1 below1. As the figure illustrates, you should not enter global capitation arrangements with up and downside risk if you are a small independent practice. It is critical to first understand the payment models to maximize your returns and outcomes for patients.

Once the right payment model is determined, it is necessary to bring in the right team to ensure success. Don’t be reluctant to leverage the external ecosystem to assist you in developing the right contracting terms and providing the data you will need to make informed and timely decisions. ACOs often structure partnerships to maximize the value they can expect from various parties, including:

- Actuaries – Actuaries can help ACOs understand statistical, financial, and patient population trends. Actuaries can also assist in developing risk models.

- External Data Sources & Analytics-as-a-Service Providers –The more data sources you have and the more robust your ability to run predictive analytics on that data, the better your financial and quality decisions will be. Analytics also provides the ability to monitor and adjust as you go based on KPI’s. Leveraging Insights-as-a-Service (IaaS) providers simply allows you to buy answers to specific queries instead of building your own analytics infrastructure, often presenting a faster and less expensive path to the desired outcome.

- Payers – Entering into ACO contracts with payers should not be thought of as a zero-sum game. Any data, analytics, or technical support that can be supplied by the payer can often be further leveraged for the success of both parties.

In keeping with the idea that this is not a zero-sum game, be sure to align the incentives down to the practitioner level. Creating a tiered shared incentive plan based on the overall goals of the ACO with all practitioners will drive the desired outcomes.

Providers and payers alike face significant upheaval in how business is conducted, and how care is delivered and reimbursed. With forethought, planning, and well-structured partnerships you can maximize your incentives, pursue strategic goals, increase quality, and boost margins.

1 Source: Adapted from Shih A, Davis K, Schoenbaum S, Gauthier A, Nuzum R, Mccarthy D. Organizing the U.S. Health Care Delivery System for High Performance. The Commonwealth Fund. 2008.